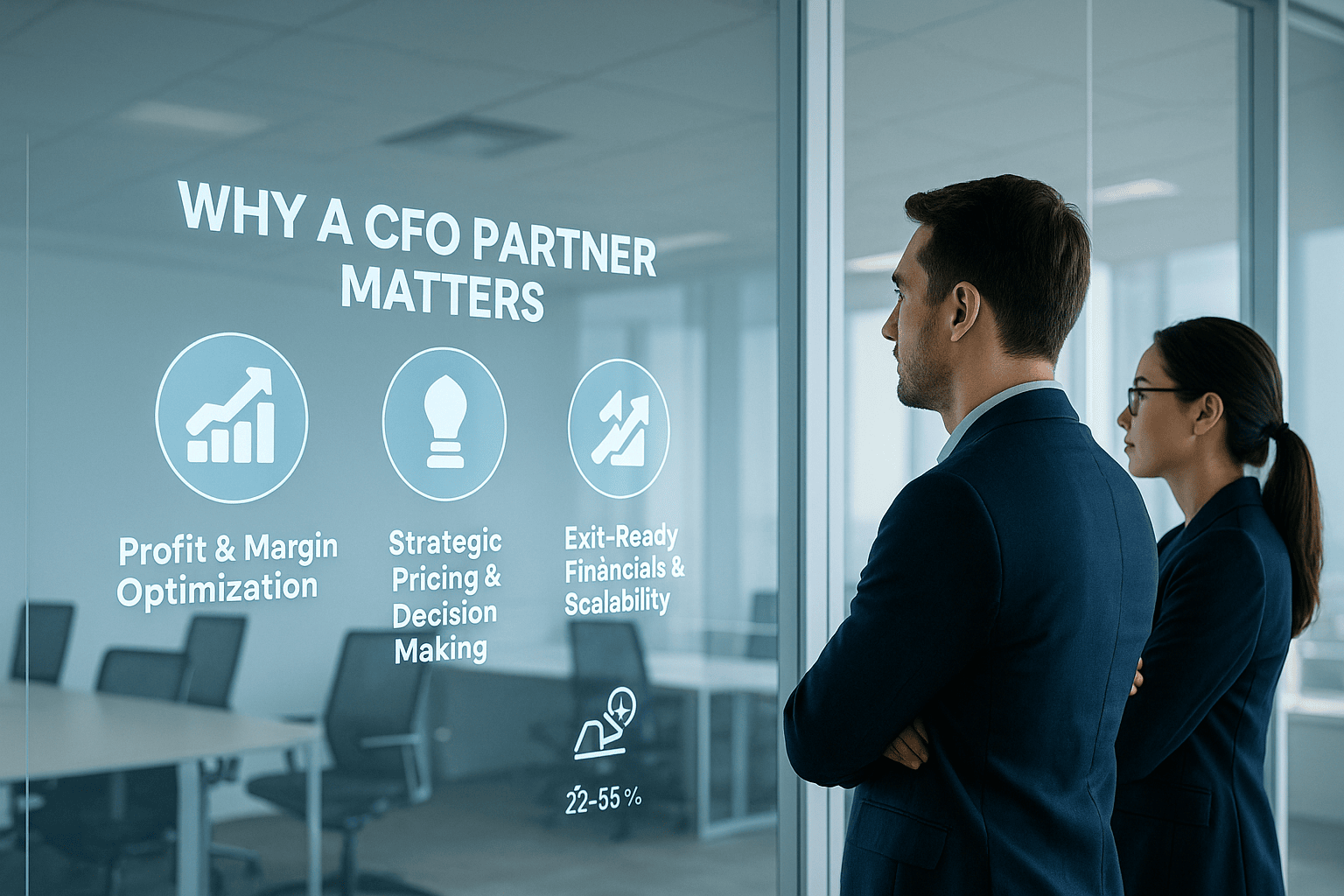

Why a CFO Partner Is Your Secret Weapon

Running an MSP requires more than technical expertise—it demands financial leadership. Here’s why partnering with a seasoned CFO adds immedi...

We help MSP & IT Services companies improve margins and cash flow and prepare to scale.

Our founder has scaled 3 firms past $130M. You could be next.

We guarantee you will see value!

We’re a team of finance professionals who’ve walked in your shoes. Each of our fractional CFOs have held C‑suite positions at high‑growth technology service organizations—including managed service providers, managed security service providers, value‑added resellers and systems integrators.

Our experience spans IT services companies of various sizes—from MSPs and IT services firms that grew from under $20 million to over $150 million, to MSPs scaling from $80 million to over $130 million. We were fortunate to be part of leadership teams where disciplined finance, rigorous analytics and a shared respect for culture helped make that rapid growth possible—without sacrificing client satisfaction.

Steve brought a blend of SaaS industry understanding, commercial discipline, and integrity to our board during my time as CEO at Webinfinity. His financial insights and strategic partnership were invaluable in guiding us through growth and ultimately to a successful acquisition by 360insights in 2022. He’s someone who knows how to build a business the right way — with both value and outcomes in mind.

James Hodgkinson CEO of Webinfinity

Core Service

Lay the groundwork for sustainable growth with hands‑on CFO support, rolling cash forecasts and real‑time dashboards that bring clarity and control to your finances.

Core Service

Transform your financial data into strategic intelligence, using advanced modeling and profitability analysis to power faster, smarter expansion.

Core Service

Stay perpetually sale‑ready with a seasoned CFO partner who enhances your valuation, de‑risks your business and guides you through every step of M&A and exit planning.

Additional Service

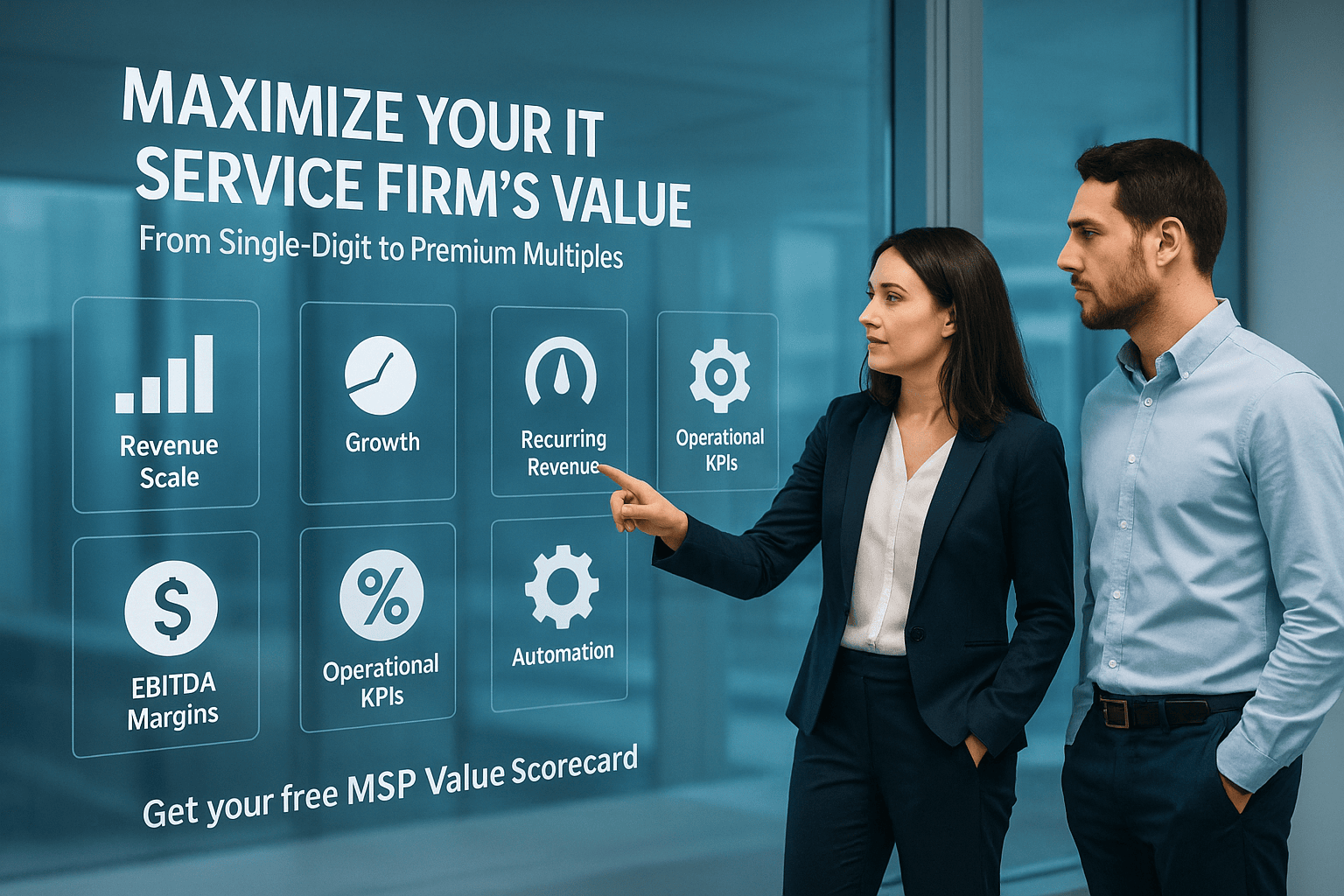

Position your business for a premium valuation with tailored strategies, clean financials, and a clear roadmap to a successful transaction.

Additional Service

Secure the right capital with strategic planning, financial modeling, and investor-ready materials that put your business in the best light.

Additional Service

Confidently navigate the deal process with expert evaluation, financial due diligence, and hands-on support—ensuring you maximize value at every stage.

PE Playbook

Private equity investments succeed or fail based on how well PE firms identify value drivers before they buy. We dig beneath the surface to assess the target’s cash, liquidity and cost structure, diagnose upside potential using industry‑proven levers Our rigorous due‑diligence support covers financial, operational and human‑capital factors, giving you confidence in your investment thesis and clarity on where to focus after closing.

Evaluate your next acquisition with confidence—schedule a discovery call to see how our pre‑acquisition expertise can unlock hidden value.

PE Playbook

The first 100 days set the trajectory for your investment. We fill CFO gaps, integrate the target company and translate the investment thesis into a detailed value‑creation roadmap. By embedding robust reporting, KPI monitoring and forecasting early, we create a clear line of sight to EBITDA improvement and working‑capital gains. Our team mentors your finance leaders, implements rolling forecasts and 13‑week cash models, and drives integration so you can achieve the operational and strategic objectives envisioned at acquisition.

Hit the ground running after closing—contact us to craft a post‑acquisition roadmap that turns your investment thesis into performance.

PE Playbook

Your portfolio companies deserve consistent financial leadership that scales across the investment lifecycle.

We provide fractional and transitional CFO services, mentoring and strategic oversight to embed best practices across the IT services firms in your portfolio.

Equip your portfolio companies with the strategic finance leadership they need—schedule a conversation to learn how our portfolio services drive value from acquisition through exit.

At two of Steve’s prior IT services companies, he engaged me and my team at MetricNet to help mature and optimize their service operations. With Steve’s partnership, we transformed those organizations from average to world-class performance within a year. Steve’s dedication to a metric-driven approach was instrumental in driving both operational excellence and profitable scaling. It’s that same focus on data and results that he now applies at CFOforIT.

At two of Steve’s prior IT services companies, he engaged me and my team at MetricNet to help mature and optimize their service operations. With Steve’s partnership, we transformed those organizations from average to world-class performance within a year. Steve’s dedication to a metric-driven approach was instrumental in driving both operational excellence and profitable scaling. It’s that same focus on data and results that he now applies at CFOforIT.

A fractional CFO provides high-level financial leadership on a part-time or project basis, giving your business access to proven expertise without the cost of a full-time executive.

We specialize in supporting MSPs, MSSPs, IT service firms, systems integrators, and value-added resellers that have already crossed $5M in annual revenue and are committed to scaling.

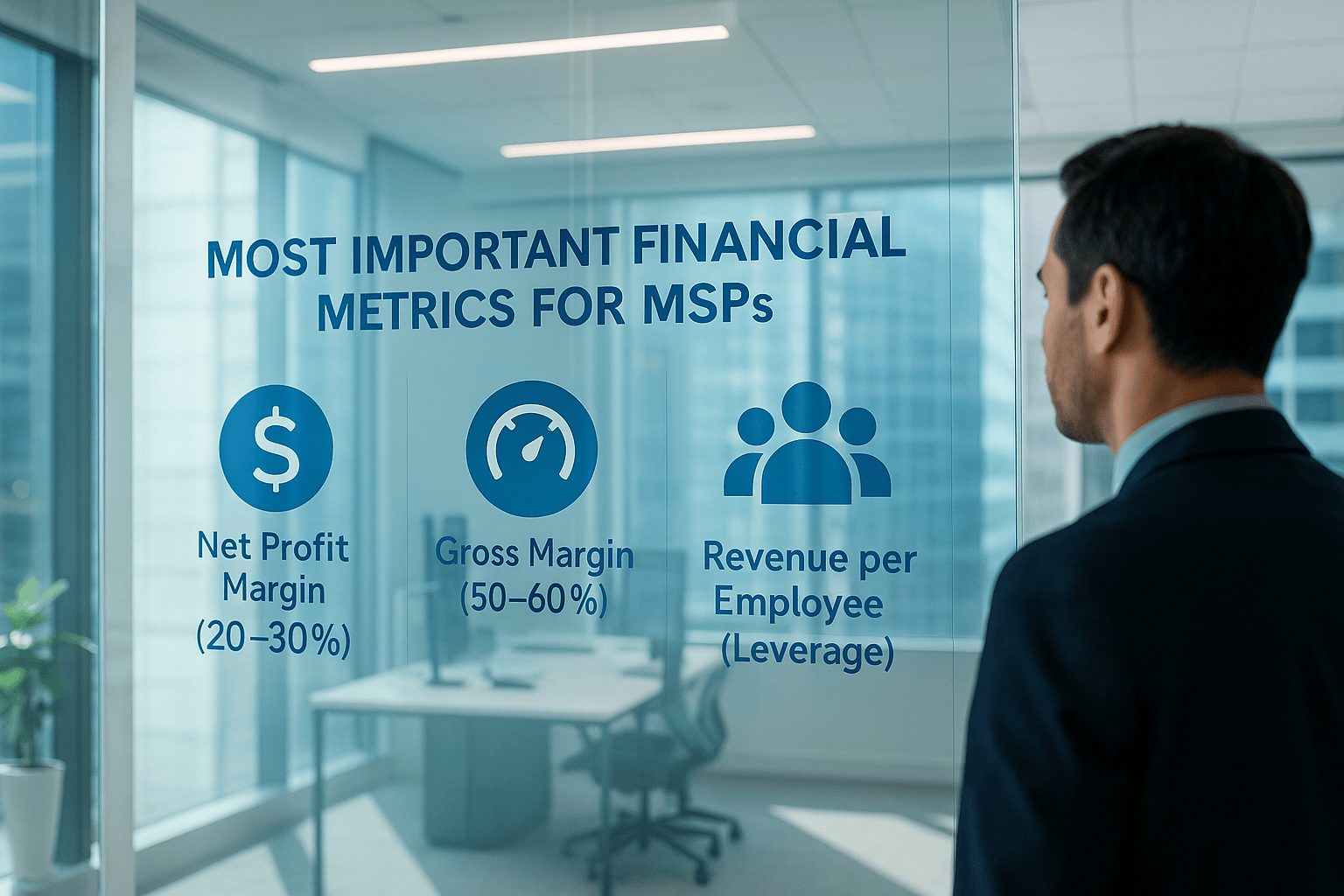

Our team has supported IT service companies through growth stages ranging from $25M to $150M+ in revenue, and MSSPs scaling from $80M to $120M+, all while improving margins, client satisfaction, and long-term business resilience.

We translate financial data into strategy—aligning pricing with value, modeling growth scenarios, building dashboards, and ensuring every investment drives profitability, scalability, and readiness for future exits.

Once your IT services business has proven its model and reached at least $5M in annual revenue, you’re at an inflection point where strategic financial leadership can accelerate growth, optimize margins, and prepare for premium valuations.

Yes. We specialize in transactional readiness—cleaning financials, mitigating risks, maximizing valuation, and guiding you through M&A and exit planning to ensure a smooth, profitable transition.

You can connect directly with a free consultation here. Alternatively, you can email us at info@cfoforit.com or call us at +1 (813) 367-4485. We’ll discuss your business goals and map out how we can help scale, optimize, or prepare for an exit.

We are confident our fractional‑CFO engagement will pay for itself. Within 60 days of kickoff you’ll receive a full financial‑health assessment, forward‑looking forecast and a prioritized action plan. If you attend the scheduled meetings, provide the requested information and implement the agreed‑upon quick‑win actions but don’t feel the engagement has delivered real value, simply let us know by Day 60 and we’ll refund your fees. In other words, we put skin in the game—if you don’t see value, you don’t pay.

I've served as a C-level executive at multiple technology services companies, navigating cash-flow crunches, margin pressure, and scaling pains firsthand.

We guarantee you will see value!

Running an MSP requires more than technical expertise—it demands financial leadership. Here’s why partnering with a seasoned CFO adds immedi...

In today’s IT Services Firm market, valuation isn’t just a metric for when you’re ready to sell. It’s a real-time indicator of operational h...

Driving Value For Your IT Services Firm: Five Core Insights Every IT Services Leader Should Know The Most Valuable Financial Metrics for IT ...

We’re a team of finance professionals who’ve walked in your shoes.